ADA Price Prediction: Technical Strength and Whale Activity Signal Potential Break Toward $1

#ADA

- Technical indicators show ADA trading above key moving averages with improving momentum signals

- Whale accumulation and institutional interest provide strong fundamental support for price appreciation

- Bollinger Band analysis suggests near-term resistance around $0.992, with $1 representing the next psychological barrier

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Building

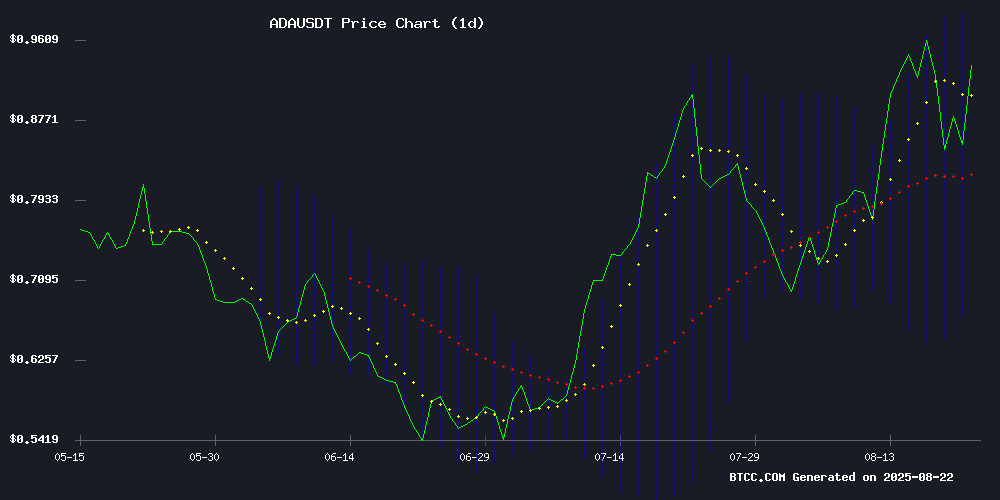

According to BTCC financial analyst Robert, ADA's current price of $0.9145 sits above its 20-day moving average of $0.8410, indicating underlying strength. The MACD reading of -0.078331, though negative, shows improving momentum with the histogram turning less negative at -0.022908. Trading NEAR the upper Bollinger Band at $0.991653 suggests potential resistance ahead, but the defense of key support levels points to continued upward potential.

Market Sentiment: Institutional Accumulation Supports Bullish Outlook

BTCC financial analyst Robert notes that recent whale accumulation of millions of ADA tokens, combined with growing institutional interest, creates a favorable backdrop for price appreciation. The defense of key support levels mentioned in recent news aligns with technical analysis, suggesting coordinated buying interest that could propel ADA toward the $1 psychological barrier.

Factors Influencing ADA's Price

Cardano Whales Accumulate Millions of ADA, Signaling Potential Upswing

Cardano (ADA) is witnessing significant accumulation by large-scale investors, with whales scooping up 150 million tokens over the past fortnight. This surge in demand from institutional players suggests growing confidence in ADA's long-term potential.

Analysts are eyeing key resistance levels, with some predicting a possible trajectory toward $10. Despite a 3.13% dip in the last 24 hours, ADA maintains a robust market cap of $30.42 billion, trading at $0.8430 with $2.24 billion in daily volume.

The derivatives market tells a nuanced story—while activity has slowed, persistently positive funding rates reveal underlying bullish sentiment. "Whales don't accumulate without reason," observes crypto analyst Ali Martinez, whose on-chain data tracks the recent buying spree.

Cardano Price Holds Key Support Amid Growing Institutional Interest

Cardano (ADA) demonstrates resilience as institutional inflows surge, with $73 million added this year and total custody holdings exceeding $900 million. The token's structural value—bolstered by liquidity, infrastructure reliability, and ecosystem maturity—appears to drive institutional allocation rather than speculative trading.

At press time, ADA traded at $0.86, clinging to a critical demand zone near $0.84. Network activity remains robust, with 112 million transactions processed and fees consistently below $0.25. Analysts note the $1 psychological level as the next major resistance test.

Cardano Price Prediction: Technical Strength Emerges as ADA Defends Key Support

Cardano's ADA is demonstrating resilience, with bulls successfully defending the $0.85 support level as technical indicators flash bullish signals. Analysts note the Relative Strength Index (RSI) remains comfortably below overbought territory, suggesting room for further upside momentum.

Market observers highlight two critical thresholds: a decisive close above $0.90 would signal initial strength, while surpassing $0.95 would confirm a broader trend reversal. On-chain data reveals substantial whale accumulation during this consolidation phase, adding weight to the bullish case.

The cooling Bitcoin dominance appears to be creating space for altcoin recovery, with ADA's oscillators now showing clear upward momentum. Should current support hold, the next significant resistance zone lies between $1.00 and $1.05, potentially marking the next phase of the rally.

Will ADA Price Hit 1?

Based on current technical indicators and market sentiment, ADA shows strong potential to reach $1. The price at $0.9145 is already testing upper resistance levels, with the Bollinger Band upper limit at $0.991653 providing a near-term target. Whale accumulation and institutional interest provide fundamental support for this move.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $0.9145 | Bullish |

| 20-day MA | $0.8410 | Support |

| Bollinger Upper | $0.9917 | Resistance |

| MACD Histogram | -0.0229 | Improving |